THE PEOPLE'S BANK

Our Money. Our Values. Our Bank.

LEARN MORE ABOUT THE LA PUBLIC BANK

PUBLIC BANKING RESOURCES

INTRODUCTION

PUBLIC BANK LA INTRO

The Municipal Bank of Los Angeles (MBLA) will be a non-profit financial institution owned by the city, established to serve and meet the needs of the local community.

OUR PRIORITIES

A FINANCIAL FUTURE FOR ALL

Advancing fiscal responsibility, community economic development, local autonomy, and responsible use of public funds to invest in Los Angeles' future.

HOW IT WORKS

TRANSFORMING LOCAL FINANCE

The LA public bank operates under the California Public Banking Act (AB 857) and will grow and protect the city’s affordable housing, accelerate the clean energy infrastructure transition, and support financial justice.

ENDORSEMENTS

BROAD-BASED SUPPORT

Public Bank LA is backed by 100+ national, statewide, regional, and local organizations, including local financial institutions, affordable housing advocates, sustainability groups, and racial justice organizations.

Jain Family Institute and Berggruen Institute

LA MUNICIPAL PUBLIC BANK SERIES

PUBLIC BANK LOS ANGELES

Transforming finance, building a prosperous future in Los Angeles rooted in community empowerment.

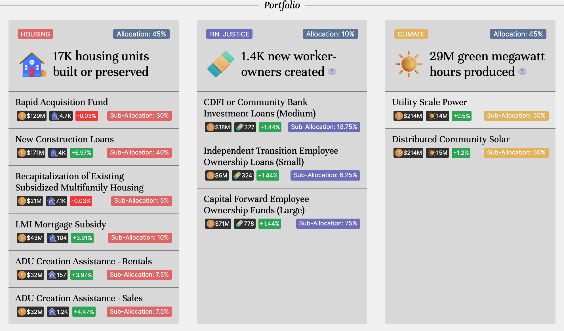

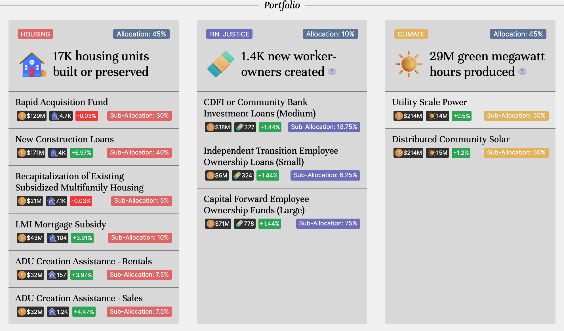

EXPANDS AFFORDABLE HOUSING OPTIONS

The LA Public Bank's affordable housing program will build over 16,000 homes within a decade of operation while returning a profit to LA taxpayers.

ACCELERATES THE LA GREEN NEW DEAL

The LA Public Bank could boost renewable energy, reduce costs, benefit LADWP, and support large-scale sustainability projects.

SUPPORTS WORKERS & SMALL BUSINESSES

The LA Public Bank will empower worker ownership of small businesses, support underserved lending, and boosts wages, job stability, and wealth creation citywide.

LA CITY COUNCIL SUPPORT

WHY LOS ANGELES SHOULD START A PUBLIC BANK

Public banking serves as a powerful tool for keeping taxpayer dollars within local communities. Public banks are non-profit lending and depository institutions owned by a local agency, such as a city or county, with a public mandate to serve the needs of the community. The Los Angeles Public Bank will leverage its deposit base and lending power to benefit LA residents with affordable housing, small business loans, modernization of public infrastructure, and other community needs.

Los Angeles taxpayers pay Wall Street banks over $340 million in fees and $1.3 billion in interest each year. Additionally, more than $2 billion of city funds are invested in petrochemical companies and multinational banks, supporting private profits at the expense of the public. By accepting deposits and handling banking services, a public bank would empower the City of Los Angeles to move public funds away from private megabanks that finance harmful activities such as fossil fuels and prioritize profit over local communities, regional development, and environmental sustainability.

The Los Angeles Public Bank will be chartered with socially and environmentally responsible mandates and will strive to serve the needs of underserved community members. The public bank will keep public money local, returning profits and interest to invest in the long-term economic health of our city. It will bring democracy and transparency to the banking and investment of public funds and will be accountable to Los Angeles communities rather than private shareholders. The result will be more customized service at a lower cost while keeping our money local and values at the forefront.

EQUITABLE ECONOMY

Invests in underserved neighborhoods, revitalizing communities and reducing disparities.

COMMUNITY ACCOUNTABILITY

Transparent investment strategies prioritize local economic development and social impact.

SUSTAINABLE GROWTH

Increases local investment, benefiting businesses, housing, and infrastructure within the community.

FISCAL RESPONSIBILITY

Reduces banking costs, freeing up revenue for other city priorities and increasing available funds.

In June 2023, the Los Angeles City Council unanimously approved moving forward with funding the Request for Proposal (RFP) to hire consultants to author the feasibility study and business plan for a proposed Los Angeles public bank. The RFP issuance represents the culmination of a historic effort to realign the city’s financial infrastructure with its values and the pressing needs of its nearly four million residents. Once complete, this plan will outline the next steps for Los Angeles to establish a public bank via a state-issued charter.

The Jain Family Institute (JFI) and the Berggruen Institute collaborated to develop comprehensive models for the Los Angeles public bank’s lending initiatives. These models encompass various critical areas, such as affordable housing, green energy, small businesses, governance, and financial justice. These reports serve as a guiding framework for the Los Angeles public bank to effectively allocate resources and support social and environmental progress in the city. The JFI and Berggruen Los Angeles municipal public bank briefings were published in May 2023.

After the historic Measure B campaign that saw over 430,000 Angelenos voting yes on a Los Angeles public bank, Public Bank LA became a founding member of the California Public Banking Alliance which sponsored and spearheaded the landmark Public Banking Act, Assembly Bill 857. This legislation empowered California cities, counties, and regions to form their own public banks, which are accountable to local communities and state regulations rather than Wall Street profit mandates. AB 857 was made law and cleared the way for Los Angeles to start a bank without a ballot measure. Public Bank LA’s work focuses on the City of Los Angeles and the broader LA area.

Public Bank Los Angeles followed our first victory by helping pass California’s second public banking bill, the Public Banking Option Act (AB 1177), signed into law by Governor Gavin Newsom in October 2021. AB 1177 creates the CalAccount Blue Ribbon Commission tasked with producing a market analysis of the CalAccount program. Upon implementation, CalAccount will provide free, universal financial services to unbanked and underbanked Californians. The Commission, which is chaired by California State Treasurer Fiona Ma, convened in September 2022 and meets on a monthly basis. CalAccount 2023 meetings are accessible to the public, and the agendas are available on the Treasurer’s website.

These legislative victories will bring responsible banking services to municipalities and the general public, ensuring that cities can redirect scarce public dollars to fund essential services and enabling people to shape the economic development of their communities. They will also help to eliminate racial and economic inequalities by guaranteeing universal access to essential banking services.

VOLUNTEER

Join our all-volunteer team and contribute your skills and expertise to the creation of a new public financial infrastructure that prioritizes the needs of our communities over the greed of Wall Street. Be a part of the historic efforts to establish the Public Bank of Los Angeles, the largest municipal public bank in the United States. Help build a future where our financial systems work for the benefit of all.